Starting a company in the UAE can be a smart move, but many foreign investors are concerned about privacy and local ownership requirements. That’s where nominee director and shareholder services come into play.

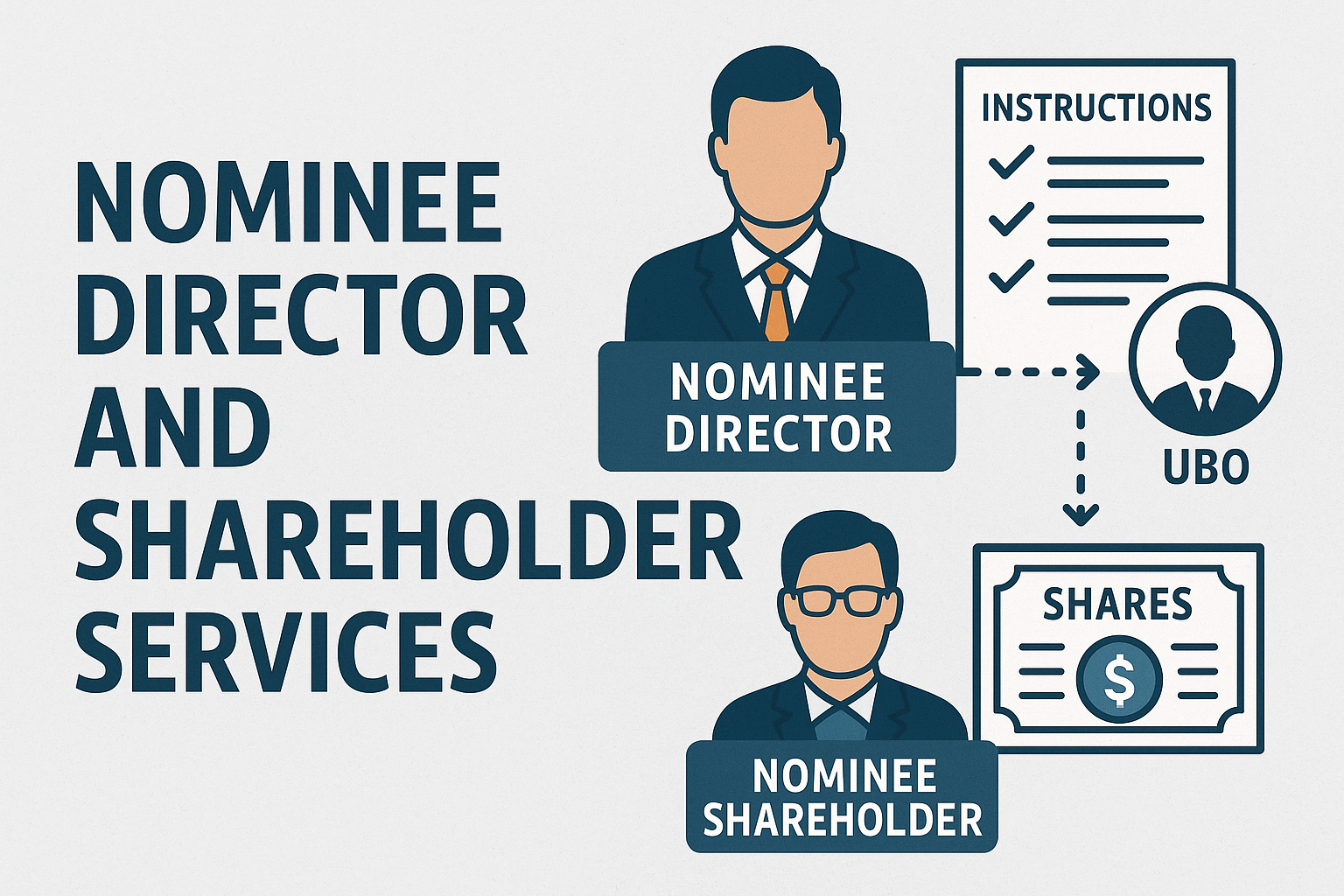

What is a Nominee Director?

A nominee director is an individual appointed to act as the company’s director on paper but does not interfere in the company’s actual operations or decisions. They’re essentially a representative of the real owner.

What is a Nominee Shareholder?

Similarly, a nominee shareholder holds shares in the company on behalf of the actual investor (the beneficiary owner). Their name appears on public records, offering privacy and asset protection to the true owner.

Why Use Nominee Services in the UAE?

- To meet local ownership requirements (especially in mainland setups)

- To ensure privacy and protect the identity of the beneficial owner

- For convenience in business structuring

- For legal compliance in cross-border ownership situations

Are These Services Legal?

Yes, nominee services are legal in the UAE as long as they are structured correctly with clear legal documentation like Nominee Agreements or Declaration of Trust to protect the beneficiary’s rights.

Conclusion:

Nominee services provide a layer of privacy, flexibility, and compliance for investors setting up a UAE business. When done with the right legal framework, they are a powerful tool for both individuals and corporations.

2. How Nominee Services Ensure Privacy in UAE Business Ownership

Privacy is a growing concern for investors and entrepreneurs—especially those operating internationally. In the UAE, nominee services offer a legally compliant way to maintain discretion while retaining full control over a business.

How Nominee Services Help with Privacy:

- The nominee’s name appears in the company’s legal documents, not the real owner’s

- The beneficial owner controls operations through private agreements, not public records

- All sensitive personal or corporate information is kept off public registries

Why Privacy Matters:

- To prevent unnecessary public exposure

- To reduce unsolicited business offers or risks of harassment

- To protect wealth and strategic assets from being openly visible

Where Are Nominee Services Used in the UAE?

- In Mainland Companies where local sponsorship is required

- In Offshore Jurisdictions (like JAFZA or RAK ICC) for global asset protection

- In Free Zones, for investors who prefer anonymity in certain operational roles

Best Practices:

- Always work with licensed service providers

- Use clear, notarized agreements between nominee and beneficiary

- Ensure nominee roles are passive, with no operational interference

Conclusion:

Nominee services are essential for privacy-conscious entrepreneurs. In the UAE, they offer a structured, transparent, and legal way to protect your identity while fully controlling your business.

3. Nominee Services in UAE: Are They Legal and Safe?

If you’re considering setting up a business in the UAE and want to stay private, you’ve probably heard about nominee services. But are they safe? Are they even legal?

Let’s Clear the Air:

✅ Yes, Nominee Services Are Legal

Nominee directors and shareholders are permitted in the UAE under proper legal agreements. They’re commonly used by foreign investors to meet local requirements or maintain privacy.

✅ They Are Safe – If Done Right

The key is to ensure nominee arrangements are backed by:

- Declaration of Trust / Beneficial Ownership Agreement

- Power of Attorney (POA) for operational control

- Non-Disclosure Agreements (NDAs) for added security

🚫 Avoid Informal or Verbal Agreements

Unauthorized or informal nominee setups can pose serious risks, including disputes or loss of ownership. Always work with reputed corporate service firms.

What to Look for in a Nominee Service Provider:

- Proven track record in UAE company formation

- Clear legal documentation

- Confidential handling of sensitive data

- Transparent pricing and service level agreements

Conclusion:

Nominee services in the UAE are both legal and safe—when set up professionally. They provide essential protection for investors seeking privacy, legal compliance, and peace of mind.